Retail: What is the privilege that e-commerce takes away from discounters

The turn of consumers to the omnichannel and the absence of discounters from the online sales channel

Monday, October 19, 2020

Business photo created by freepik - www.freepik.com

Business photo created by freepik - www.freepik.com

As lockdown left few alternatives available to consumers for their stoppings, when the pandemic broke out, e-commerce quickly became an essential tool for retailers. According to Nielsen, six months later, this ‘early’ dependence became a key parameter of the evolving omnichannel experience, which is gaining more and more acceptance among consumers.

As e-commerce became a tool for consumers to manage their expenses, Neilsen considers crucial for brands and retailers, to review their goals by monitoring the characteristics that will determine consumer habits from now on, in order to attract consumers with a limited budget. It is important to note that, historically, low-income consumers have been attracted by the discounters, a trend that is reportedly reversing. However, discounters have limited presence online.

The turn of low-income consumers to e-shops

At this point, it should be clarified, that Nielsen classifies consumers into two categories, those with lower incomes who are looking for a way to save money (constrained consumers) and those with middle to high income, with little or no impact of pandemic in their employment.

This second category (insulated consumers), because of the restrictive measures, may enter into transactions that will replace their previous activities outside the home.

For the first category, the change in indexes is more important: 31% are ‘new’ to online shopping and, 30% shop online several times a week. Now, 20% in this category, use regularly the internet as the most popular channel.

Compared to the second group, this particular consumer group browses more time in an online store, pays more attention to prices and, has more time to search for offers and products. In Europe in particular, 65% of low-income consumers have turned to omnichannel markets, while lower (54%) is the percentage, of the wealthier consumers, who have adopted this habit.

In contrast, 44% of the second group, shop from physical stores, while 34% of Europeans still visit supermarkets for their basic stoppings.

Only 1% trust e-commerce exclusively

After extended periods of stay at home, the omnichannel model seems to be more promisive in the future.

According to study by the measurement company, only 9% of consumers worldwide did online purchases, in regular basis, before the Covid-19 broke out.

When the coronavirus entered everyone’s life, 27% of consumers experienced online sales for the first time.

In May 2020, 44% of consumers in global level, said that they shop online every week, with 23% saying that they shop online several times a week.

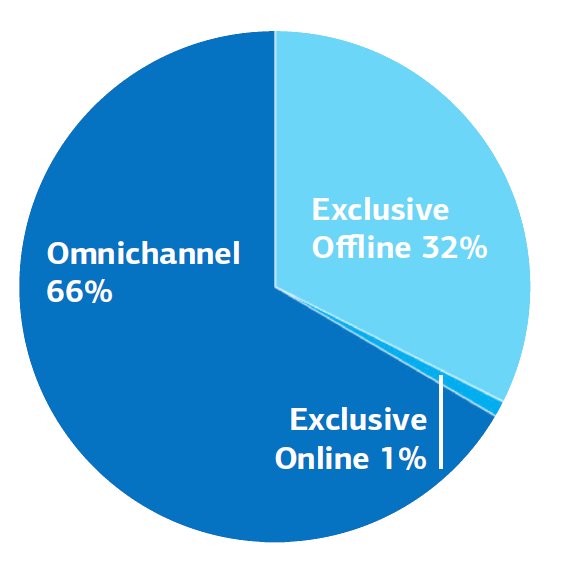

As shown in the table below, 2/3 of consumers visit physical and online stores, 1/3 shop exclusively offline, while only 1% visit only online stores.

Source: FOODReporter #0370/15-10-2020